Using stop -Loss orders to protect investments in cryptocurrency

The world of cryptocurrency continues to develop and investors are increasingly aware of the importance of protecting their investments against market volatility and opportunities. An effective risk management strategy is to use StOP -LOS’s orders in its cryptocurrency transactions.

What is Stop Londer’s order?

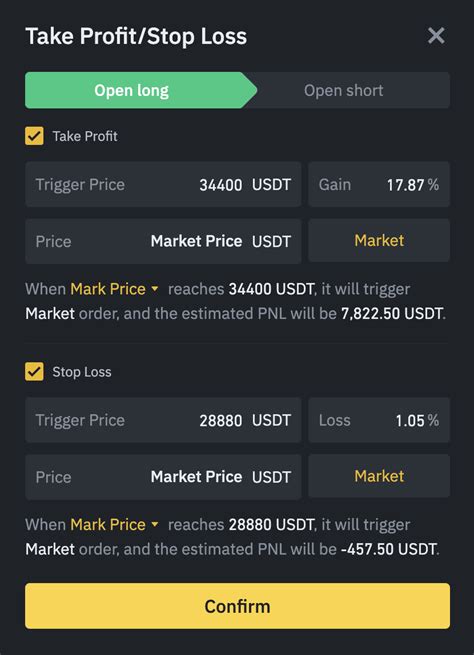

The Stop -Loss order is an automatic order for the sale or a close position if it falls under a certain price level, which is referred to as a stop -without. This type of order is intended to limit potential losses and protect investors from a significant loss of value. If you place an order for a stop loss, you basically determine the price you can sell your cryptocurrency and another market decline promotes sales.

How do you stop loss orders

This is how it works:

1

2.

- Attributed to the order: If the price drops below the price loss price, the automatic trading system for sale or closed trading is traded.

The advantages of using stop losses

The use of Stop -Loss orders offers several advantages that can help protect your cryptocurrency investments:

- Risk management: If you restrict potential losses, you can avoid considerable financial losses due to market volatility.

2.

3.

Tips for the efficient use of Stop -Los’s orders

Follow the following tips to get all options from Stop -Los’s orders:

1

2.

- Monitoring market fluctuations: Watch market trends and adapt your list loss orders accordingly.

- Communicate with other risk management strategies: Not only rely on the termination of orders – consider how you can be reconciled with other risk management strategies such as positions and diversification.

Example of real life: Using Stop -Loss orders to protect the cryptocurrency investment

Suppose you invested 10,000 US dollars in Bitcoin (BTC) last year and set $ 20,000 for the loss of suspension. In the next 6 months, the price was between 15,000 and 25,000 US dollars, which led to significant losses.

To mitigate these losses, you can use the stop -Loss order to automatically sell your Bitcoin if it fell below 20,000 US dollars. In this way, they would have avoided sales at an even cheaper price by reducing potential losses.

Diploma

The use of stop losses is a simple but effective way to protect your cryptocurrency investment from market volatility and potential losses. By determining the prices for real suspension, combination with other risk management strategies and monitoring of market fluctuations, you can reduce the effects of market closures on your portfolio. Remember that the investment in cryptocurrencies is getting better to go wrong. The use of Stop -Los’s orders can control your investment and sleep at night.

Refusal to responsibility:

This article only serves for information purposes and should not be viewed as investment tips.