Understanding bull feelings in the cryptocurrency market

The Crypto Currency World has experienced a meteoric increase in recent years, and some coins have experienced exponential growth. However, in the midst of excitement and optimism, many investors remain skeptical, wondering if this trend will continue or even turn. In order to gain a deeper understanding of bull feelings in the cryptocurrency markets, it is crucial to enter the psychology behind the market behavior, the factors that affect the confidence of investors and the technical aspects of cryptocurrency trading.

What is a bull’s feeling?

Bullish sentiment refers to the overall attitude towards a certain capacity or asset class. Bullish investor expects growth and success in his portfolio, while the bear investor expects losses and declines. In the context of the Crypto currency, bikovo feelings are manifested as optimism regarding future prices movement, in the rates of adoption and market trends.

Why do investors believe in crypto currency?

There are several reasons why investors believe in the cryptocurrency of the currency:

- Potential for high yields : Many investors view cryptocurrency currency as a way to diversify their portfolios and potentially make high yields.

- Decentralization and autonomy : CRIPTO currency act independently of central banks and governments, which complains of investors seeking financial independence.

- Safety and limited supply : Most CRIPTO currency has a limited supply, reducing the risk of inflation and making them more attractive to investors.

- Innovation and Technology : Blockchain technology behind the Crypto currency can be seen as an exchanger of industry games such as finances, supply chain management and voting systems.

Factors that affect bull feelings in cryptocurrency

Several factors contribute to bullish feelings in the crypto markets:

- The trust of the Hedge Fund and investors : institutional investors such as Hedge funds and individual merchants often invest in the Crypto currency because of their perceived high potential yields.

- Mainstream Adoption : The growing adoption of the Crypto currency by the main institutions, such as institutional investors and large corporations, may increase trust in the market.

3

- Regulatory environment

: favorable regulatory environments and reduced regulatory barriers can make cryptocurrency currency more attractive to investors.

Technical aspects of cryptocurrency trading

Understanding the technical aspects of cryptocurrency trading is crucial to making informed investment decisions:

- Market Trends : Understanding market trends, such as growing or trendy fall, can help traders identify opportunities to buy or sell.

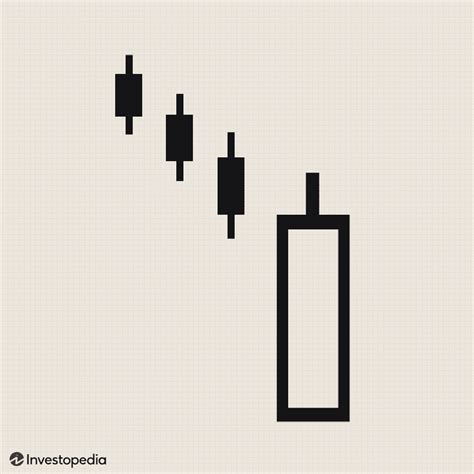

- Samples of increase and fall : identifying movement of prices based on samples, including an increase and a fall in trend, can help predict future prices behavior.

- Time frames and market size : use of different time frames (eg 1-hour, 4-hour, 1-day) and market size indicators (eg quantity, candlestick samples) for prices analysis.

- Volatility trading : Understanding the trading strategy for volatility, such as a system of piercing and reversal, can help retailers to manage risk.

Challenges and Risks of Bull’s feelings

Although bulls in crypto markets offer many advantages, it also represents several challenges and risks:

- Market volatility : Cryptum prices are known for their volatility, which can lead to significant prices changes.

- Safety Questions : Decentralized Nature of the Crypto Currency makes them vulnerable to hacking and security threats.

3.