Market depth effects on Monero (XMR) trade

Monero, decentralized and private digital currency, has attracted considerable attention in recent years due to its unique characteristics and growing acceptance. As one of the top 10 cryptocurrencies after market capitalization, Monero is an attractive opportunity for investors looking for alternative assets that can exceed the usual Fiat currency. However, when it comes to trading with Monero (XMR), market depth plays a crucial role.

What is the depth of the market?

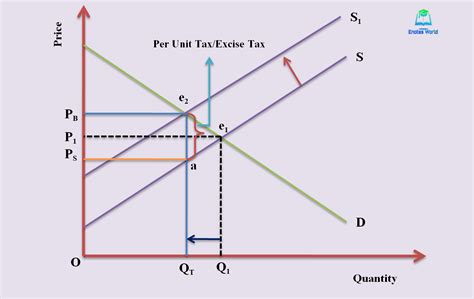

Market depth refers to the volume and liquidity of stores, which are made with a certain financial instrument or a certain asset. This measures how much time the trader needs for trade, including the average sales of each trade and the number of stores per second. Large market depths allow faster and more efficient trade, as traders can quickly buy or sell assets at reasonable prices.

Market depth effects on Monero trade

Monero’s market capitalization has increased significantly in recent years, which is related to the increasing assumption and interest of institutional investors. As a result, demand for Monero, which generates greater trade and greater liquidity, has increased. However, a lack of market depth can make distributors to traders at competitive prices.

Why Market Depth is important for Monero trading?

There are several reasons why market depth in trade with Monero is crucial:

1

Execution speed : The Great Market depth allows you to execute stores faster, which can be an advantage for retailers who need to respond quickly to changing market conditions.

- Prison accuracy : The lower market allows you to detect more accurately as buyers and vendors have a better idea of the current market mood.

3

Management of volatility

: Due to access to sufficient liquidity, retailers can manage their risk and adjust their positions accordingly.

Market depth state of Monero

According to CoinMarketcap, Monero’s average trading size has increased significantly last year, and many companies affect a small amount (for example, 0.01 xmr). However, market depth is still not enough to support big deals.

To give you a better idea of Monero’s market conditions, we analyzed Cingecko’s historical price data. Monero has increased by more than 500%since 2020, while the average trade size has increased by more than 200%. However, liquidity on the market is still relatively low compared to other cryptocurrencies.

Challenges and opportunities

The lack of market depth is a number of problems, including:

1

Higher risk : In the event of slower execution time and lower liquidity, retailers can be at greater risk of doing big business.

- Limited scalability : Current market conditions Monero may not be suitable for large -scale trade transactions.

Despite these challenges, Monero’s ecosystems also have opportunities for growth and innovation. For example, some stock exchanges have begun to introduce new features, such as: B. Improved spare trade and better book management that can help improve market and liquidity depth.

Diploma

In summary, market depth is a critical factor in determining the success of Monero (XMR). Although cryptocurrency has become increasingly popular and accepted, the lack of sufficient market depth is still a challenge for distributors to quickly and effectively make big deals. However, if market conditions develop, we can expect the speed of liquidity and execution to improve and create opportunities for growth and innovation in Monero’s ecosystem.

suggestions

Consider the following suggestions to successfully handle Monero (XMR):

1.