P2P Cryptocurrency: Improving the Security of Large Withdrawals

The rapid growth of cryptocurrencies has led to an increase in peer-to-peer (P2P) transactions, with many users choosing to use decentralized networks over traditional payment processors. P2P cryptocurrencies offer several advantages over centralized systems, including increased security and anonymity. However, one area where P2P cryptocurrencies fall short is in large withdrawal processes.

The Problem with Large Withdrawals

Traditional payment processors typically charge high fees for large transactions, which can be costly for users who require frequent or large withdrawals. In contrast, P2P cryptocurrencies often charge lower transaction fees and offer faster settlement times, but these benefits are not always available for large withdrawals.

Security Concerns for Large Withdrawals

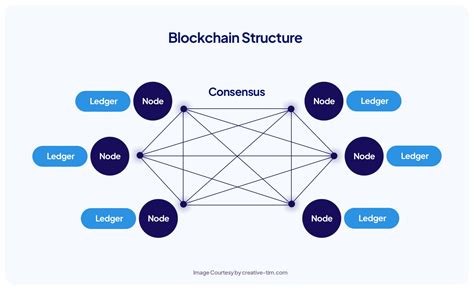

Large withdrawals from traditional payment processors can also pose security risks due to the need to verify user identities, authenticate transactions, and comply with anti-money laundering (AML) regulations. P2P cryptocurrencies offer an attractive solution by providing a decentralized network that eliminates the need for intermediaries, reducing the risk of unauthorized access or tampering.

The Benefits of P2P Cryptocurrency for Large Withdrawals

So how can P2P cryptocurrencies improve the security of large withdrawals? Here are some key benefits:

- Lower Transaction Fees: P2P cryptocurrencies often charge lower transaction fees than traditional payment processors, reducing the financial burden on users.

- Faster Settlement Times: P2P transactions are typically settled quickly, often within seconds or minutes, whereas traditional payment processors can take days or even weeks to process large withdrawals.

- Increased Security: By leveraging their decentralized networks, P2P cryptocurrencies can offer robust security features, such as encryption and secure communication protocols.

- Improved User Experience: P2P transactions can offer a smoother user experience, with faster transaction processing and reduced reliance on intermediaries.

Challenges and Future Developments

While P2P cryptocurrencies offer many benefits for large withdrawals, they still face challenges in this area. Some of these challenges include:

- Regulatory Environment: The regulatory environment surrounding P2P transactions is still evolving and users may need to comply with AML regulations.

- Scalability

: As demand for P2P cryptocurrencies increases, it will be essential to develop a scalable infrastructure that can handle large transaction volumes.

Conclusion

The security concerns associated with large withdrawals in traditional payment processors are significant. By leveraging their decentralized networks and robust security features, P2P cryptocurrencies offer a promising alternative for users seeking increased security and flexibility when making large withdrawals. As the cryptocurrency industry continues to evolve, it is essential to address these challenges and develop an infrastructure that can meet the growing demands of users around the world.

Additional Resources

- [Securities and Exchange Commission (SEC) Issues Guidance on P2P Trading](

- [European Union Anti-Money Laundering Regulation]( justice/home-affairs/law/unified-regulation/criminal-law/eu-criminal-laws-and-executive-institutions/money (-blanchiment/eu-mnl_fr.htm)

- [The Decentralized P2P Exchange Network](