The Rise and Fall of Cryptocurrencies: A Beginner’s Guide to Cryptocurrency, Coins, Caps, and Assets

The financial world has undergone a significant transformation over the past decade with the emergence of cryptocurrencies. From Bitcoin to Ethereum and from Litecoin to Dogecoin, these digital currencies have captured the imagination of millions around the world. But what exactly is a cryptocurrency? How do coins work? And why are they so valuable? In this article, we will delve into the world of cryptocurrencies, explore its key concepts, and provide an overview of the cap and assets.

What is cryptocurrency?

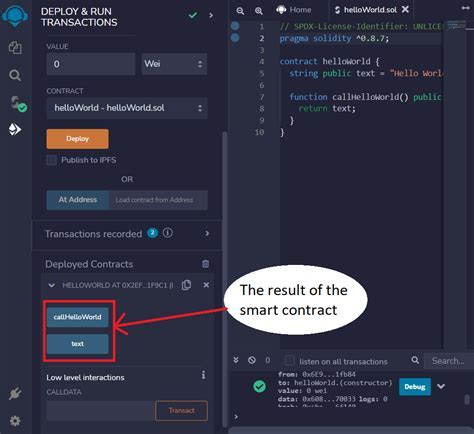

Cryptocurrencies are digital or virtual currencies that use cryptography to secure financial transactions. They are created using a process called blockchain technology, which records all transactions on a public ledger called the blockchain. Each coin has a unique address, a private key, and a public key that allows users to send and receive funds securely.

The most well-known cryptocurrency is Bitcoin (BTC), which was launched in 2009 by an individual or group using the pseudonym Satoshi Nakamoto. Other popular cryptocurrencies include Ethereum (ETH), Litecoin (LTC), and Monero (XMR). Cryptocurrencies operate on a decentralized network, meaning they are not controlled by any central authority.

Coins: Cryptographic Keys

A coin is simply a digital currency that uses cryptography for security and decentralization. Each coin has its own unique properties, such as:

- Private Key: A private key allows users to receive funds from other accounts.

- Public Key: A public key allows users to spend coins for transactions.

- Blockchain: A blockchain records all transactions on a public ledger.

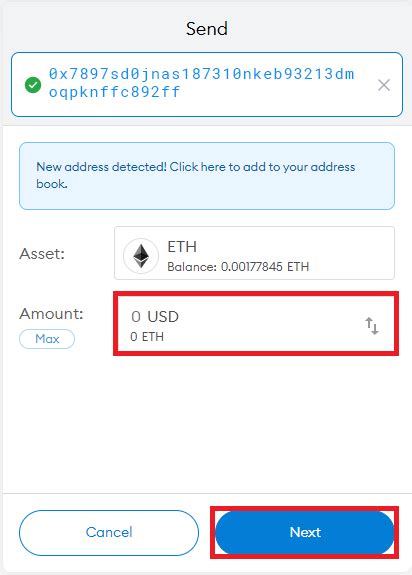

Coins are stored in digital wallets, which can be software-based (such as MetaMask) or hardware-based (such as Ledger). Users can buy, sell, and trade coins using online exchanges or peer-to-peer markets.

Capitalization: The Value of Cryptocurrencies

Capitalization refers to the price of a cryptocurrency. It is calculated by multiplying the total supply of a coin by its current market value. In other words, capitalization is a measure of how much investors are willing to pay for a particular coin.

Cryptocurrency prices fluctuate rapidly due to a variety of factors, such as:

- Market Sentiment: Investors’ emotions and opinions influence prices.

- Supply and Demand: The balance of buyers and sellers determines the price.

- Regulatory Changes: Government policies or laws can affect market stability.

- Technical Improvements: New features, updates, or partnerships can drive prices up.

To give you a better idea of the capitalization, here are some current values of popular cryptocurrencies:

- Bitcoin (BTC): around $43,000

- Ethereum (ETH): around $3,500

- Litecoin (LTC): around $200

Crypto Assets: The Future of Finance

Cryptocurrencies are not just digital currencies; they are also a new type of property. An asset is an item that can be bought, sold, traded, and stored.

The concept of crypto assets is based on the technology behind cryptocurrencies, which ensures:

- Decentralized: Cryptocurrencies operate independently of central banks.

- Secure: Transactions are encrypted and protected by cryptography.

- Transparent

: All transactions are recorded on a public ledger called the blockchain.

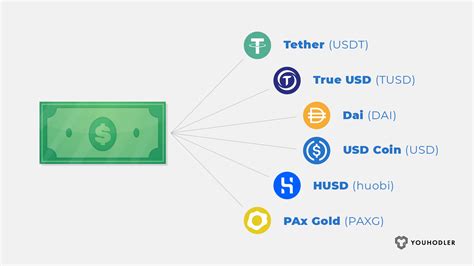

As the value of cryptocurrency continues to grow, we can expect the emergence of new crypto assets such as stablecoins (which aim to provide a stable price for cryptocurrencies) and non-fungible tokens (NFTs).

Conclusion

Cryptocurrencies have come a long way since their inception in 2009. From Bitcoin to Ethereum, Litecoin to Dogecoin, these digital currencies have captured the imagination of millions around the world.