Stablecoins in Emerging Markets: Opportunities and Challenges

The rise of cryptocurrencies has brought about a new era of financial innovation, with many emerging markets adopting digital currencies to increase efficiency, reduce transaction costs, and promote economic growth. One of the most promising applications of stablecoins is in emerging markets, where traditional fiat currencies may not be available or may have limited adoption.

What are Stablecoins?

A stablecoin is a digital currency that is pegged to the value of a fiat currency. This means that its value is fixed and does not fluctuate with market conditions, providing a stable store of value for investors. Stablecoins are designed to be used as a medium of exchange, just like traditional currencies, but they are also backed by a reserve of assets, such as gold or other valuable commodities.

Advantages of Stablecoins in Emerging Markets

- Increased Adoption

: Stablecoins offer an alternative to traditional fiat currencies, which may not be available or may have limited adoption in emerging markets. By providing an alternative store of value and a convenient payment method, stablecoins can increase the adoption rate of digital payments.

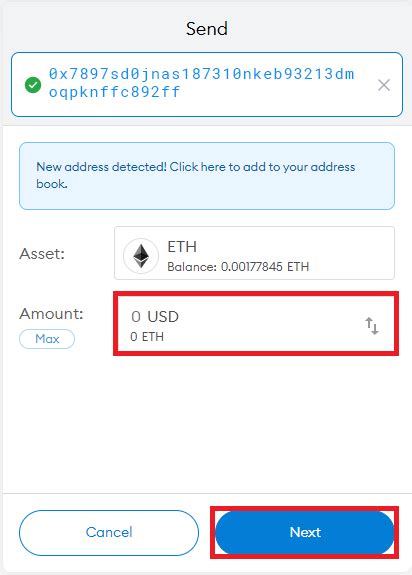

- Reduced Transaction Costs: Stablecoins eliminate the need for intermediaries, such as banks and payment processors, reducing transaction costs and increasing efficiency.

- Increased Accessibility: Stablecoins can provide financial services to underserved populations in emerging markets, who may not have access to traditional banking systems due to lack of infrastructure or expertise.

- Improved Liquidity: Stablecoins offer improved liquidity compared to traditional currencies, as they are often traded on regulated exchanges and have a large user base.

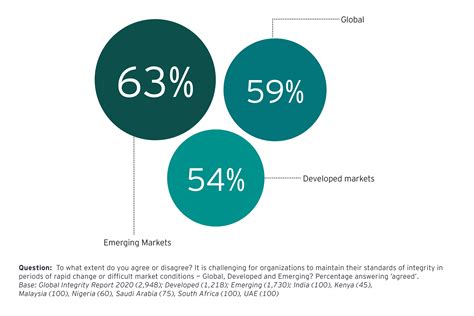

Challenges Faced by Stablecoins in Emerging Markets

- Regulatory Risks: Stablecoins may be subject to regulatory scrutiny in emerging markets, where governments may view them as unregulated or untrustworthy.

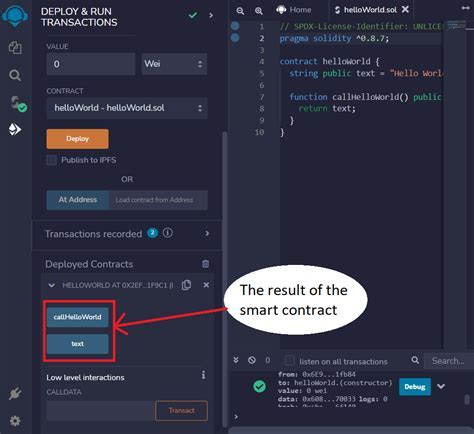

- Security Risks: Stablecoins are vulnerable to cyber attacks and other security risks, which can compromise user funds and undermine confidence in the stablecoin ecosystem.

- Liquidity Risk: While stablecoins have improved liquidity compared to traditional currencies, they still face challenges related to market volatility and liquidity risk.

- Scalability Risks: Stablecoins may not be suitable for high-frequency trading or large-scale transactions, which can create scalability risks.

Successful Implementation of Stablecoins in Emerging Markets

- China: RMB Stabilized by PBOC’s “One Belt One Road” Initiative: China has implemented a stablecoin system to support its growing economic infrastructure and promote foreign trade.

- South Korea: KRW Stabilized by Central Bank’s “New Payment System”

: South Korea’s central bank has introduced a stablecoin, the Korean Won Stablecoin (KBS), to provide an alternative store of value and facilitate payments within the country .

- India: Rupee Stabilized by Reserve Bank of India’s “Digital Rupee” Initiative: The Reserve Bank of India has launched a digital rupee initiative, which aims to promote digital payments and reduce transaction costs in India.

Conclusion

Stablecoins offer an attractive alternative to traditional fiat currencies in emerging markets, providing increased adoption, reduced transaction costs, and improved accessibility. However, stablecoins also face regulatory risks, security risks, liquidity risk, and scalability risks that must be addressed. Successful implementation of stablecoins requires careful consideration of these challenges and a strategic approach to regulation, security, and liquidity provision.

Recommendations for Stablecoin Adoption

- Regulatory Framework: Establish clear regulations and guidelines for the development and deployment of stablecoins.