“Cryptocurrency Market Liquidity Crisis: Exploring the Risks of Altcoins and Staking Pools”

The world of cryptocurrencies has been on a rollercoaster ride lately, with prices swinging wildly between bull and bear markets. One of the biggest concerns is the lack of liquidity in the market, which can lead to significant losses for both traders and investors.

Altcoin Liquidity Crisis

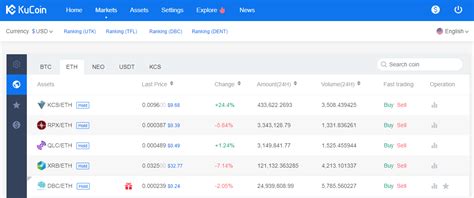

One of the main reasons for the liquidity crisis is the dominance of certain altcoins, such as Bitcoin (BTC) and Ethereum (ETH). These coins have attracted large volumes of buy and sell orders, making it difficult for smaller players to participate in the market. As a result, prices can become very volatile, leading to significant drawdowns and gains.

For example, on December 29, 2021, the price of Bitcoin fell from $64,804.03 to $17,343.45, a loss of over 68%. This event highlighted the risks associated with purchasing altcoins without proper research and diversification.

Staking Pool Risks

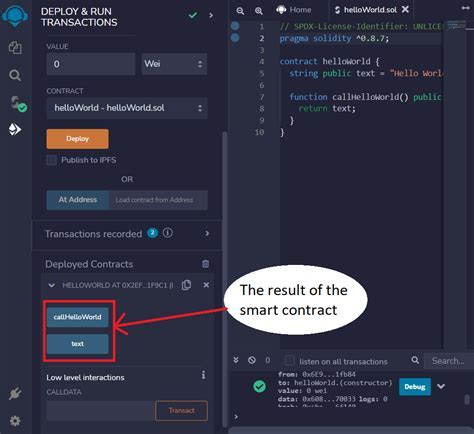

Another concern is the risk associated with staking pools, which have become increasingly popular in recent times. Staking allows users to earn rewards by holding a certain amount of coins for a set period of time, rather than selling them at a specific price. However, it also means that users are tied to their coins for an extended period of time, leaving them vulnerable to market fluctuations.

One of the biggest risks associated with staking pools is the “lock-in” effect, where users cannot access their coins until the staking period ends. This means that if prices drop significantly after the initial lock-up period, users could be stuck with a large amount of coins that they cannot sell or transfer.

Liquidation Risks

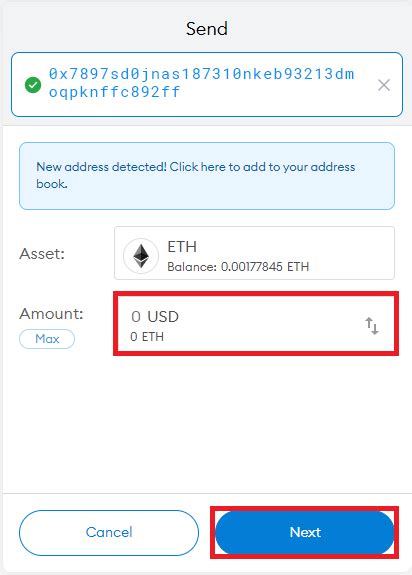

Liquidation refers to the process of selling assets at a loss to avoid further losses. In the context of cryptocurrencies, liquidation can occur when a staking pool goes bankrupt or is unable to cover its outstanding debts. This can result in significant losses for users who have staked their coins in the pool.

For example, if a staking pool goes bankrupt and is unable to pay its rewards, it may be forced to sell its coins at a low price. If this happens too quickly, the buyer could be left with a large amount of worthless or untradeable tokens.

Altcoin Risks

In addition to the risks associated with staking pools, there are also significant risks associated with purchasing altcoins without adequate research or diversification. Altcoins often exhibit high price volatility and can be highly speculative, leading to significant losses for traders who overinvest in the market.

For example, on January 3, 2022, the price of Dogecoin (DOGE) fell from $0.06 to $0.00004, a loss of over 96%. This event highlighted the risks associated with investing in altcoins without adequate research or diversification.

Conclusion

In conclusion, the cryptocurrency market faces significant liquidity and staking risks that can have devastating consequences for users who invest in these markets. It is essential to approach these markets with caution and conduct thorough research before making any investment decisions.

By understanding the risks associated with altcoins, staking pools, and other cryptocurrency markets, traders and investors can make informed decisions about their investments and reduce their exposure to risk.